PropNex Picks

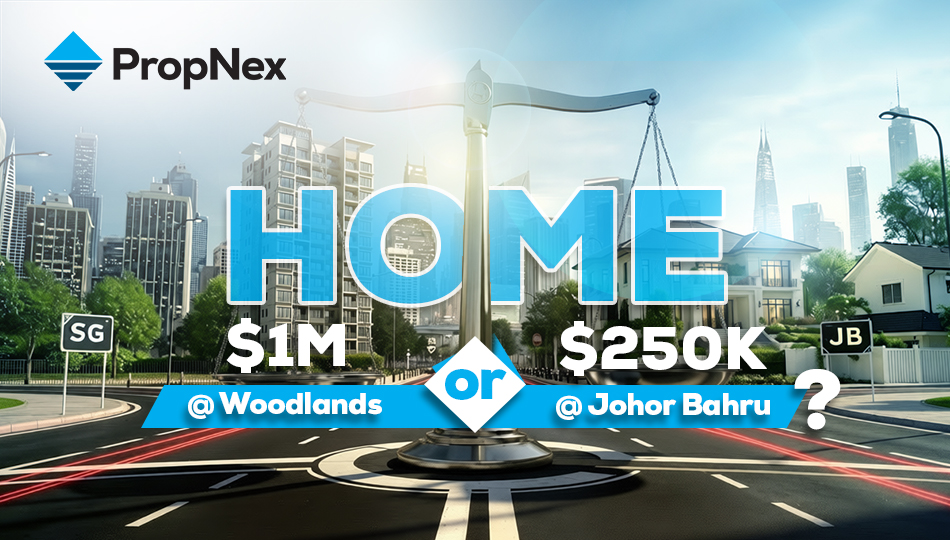

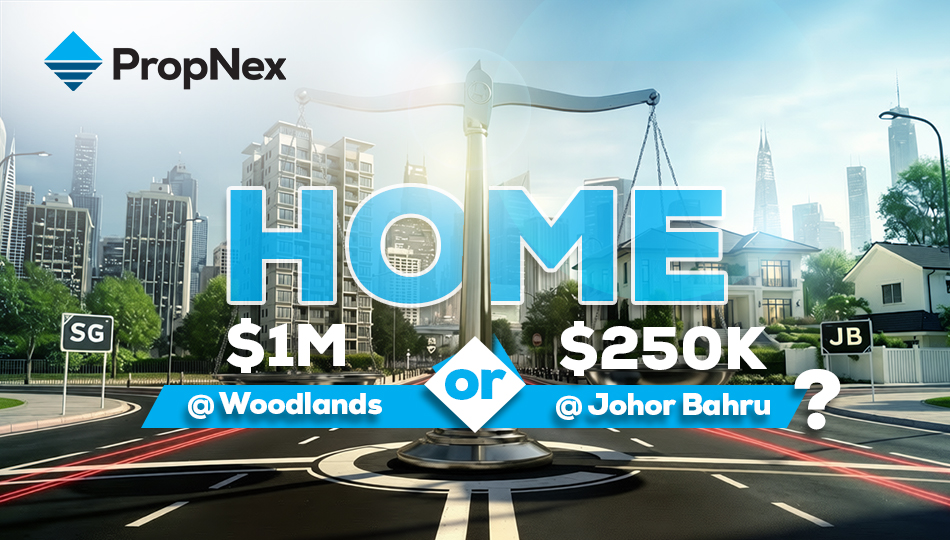

|February 03,2026Home: $1M @ Woodlands vs $250K @ Johor Bahru?

Share this article:

$1 million.

That number sounds big... until you try to buy a home with it. Suddenly it's not enough money.

Realistically speaking, a million dollars might get you a 2- to 3-bedroom condo in Woodlands. But a similar unit in JB is just a fraction of that. One train ride away, yet four times cheaper!

At first glance, this looks like a simple price comparison. But there are actually many things to consider, from the upcoming RTS link to the Johor-Singapore Special Economic Zone (JS-SEZ). So, in this article, we'll help you decide if it's worth paying $1 million for a home in Woodlands, or if you should just get a cheap JB property and call it a day.

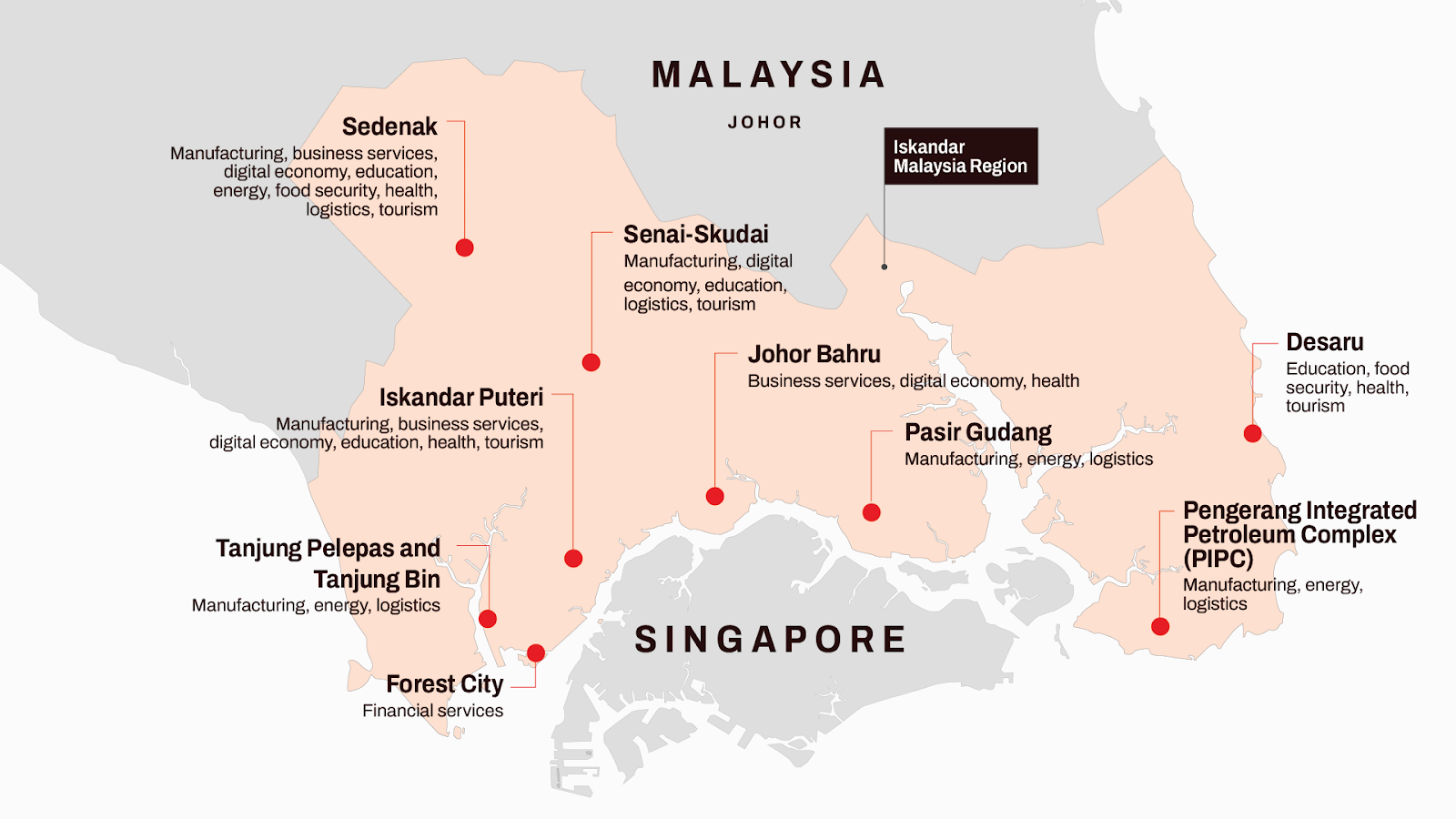

The JS-SEZ is why we're having this conversation in the first place. This zone is a major collaboration between Malaysia and Singapore to boost cross-border economic growth, attract investment, and improve connectivity. Spanning more than 3,500 km2 (over four times the size of Singapore!), the JS-SEZ covers key growth areas such as Iskandar Malaysia, Pengerang, and nine other designated flagship zones.

These zones aren't focused on just one industry either. Instead, they're designed to attract investments across a broad mix of sectors, from business services and the digital economy to manufacturing, logistics, healthcare, energy, food security, and tourism.

Source: Enterprise Singapore

Obviously, none of this would be possible without the Rapid Transit System (RTS) Link, which is set for completion later this year. This rail connects Woodlands North MRT/RTS station and Bukit Chagar in JB with a short 6-minute commute, and will have an improved immigration clearance to help with traffic flow.

That being said, there are still concerns about traffic since the RTS will only be able to transport up to 10,000 passengers per hour in each direction. Meanwhile, CNA has reported that around 300,000 people commute the Causeway on a daily basis, with traffic projected to grow by about 40% by 2050. So although the RTS will take some load off road traffic, it may also become heavily utilised itself during peak periods as cross-border commuting increases.

For years, Woodlands was known mainly as the place you passed through on the way to JB. Not the destination. But things are changing fast. To further promote the success of the JS-SEZ and RTS link, URA has plans to turn the town into the economic hub of the Northern Gateway, with enhanced connectivity and transport integration.

Woodlands Regional Centre (WRC) will be made up of distinct precincts designed for different functions:

- Woodlands Central: core node for office, retail, and pedestrian activity.

- Woodlands Gateway: linked to the RTS station, geared for jobs, research nodes, and new-generation industries.

- Housing by the Woods: residential community integrated with nature.

- Woodlands Waterfront: waterfront area with varied housing and public spaces.

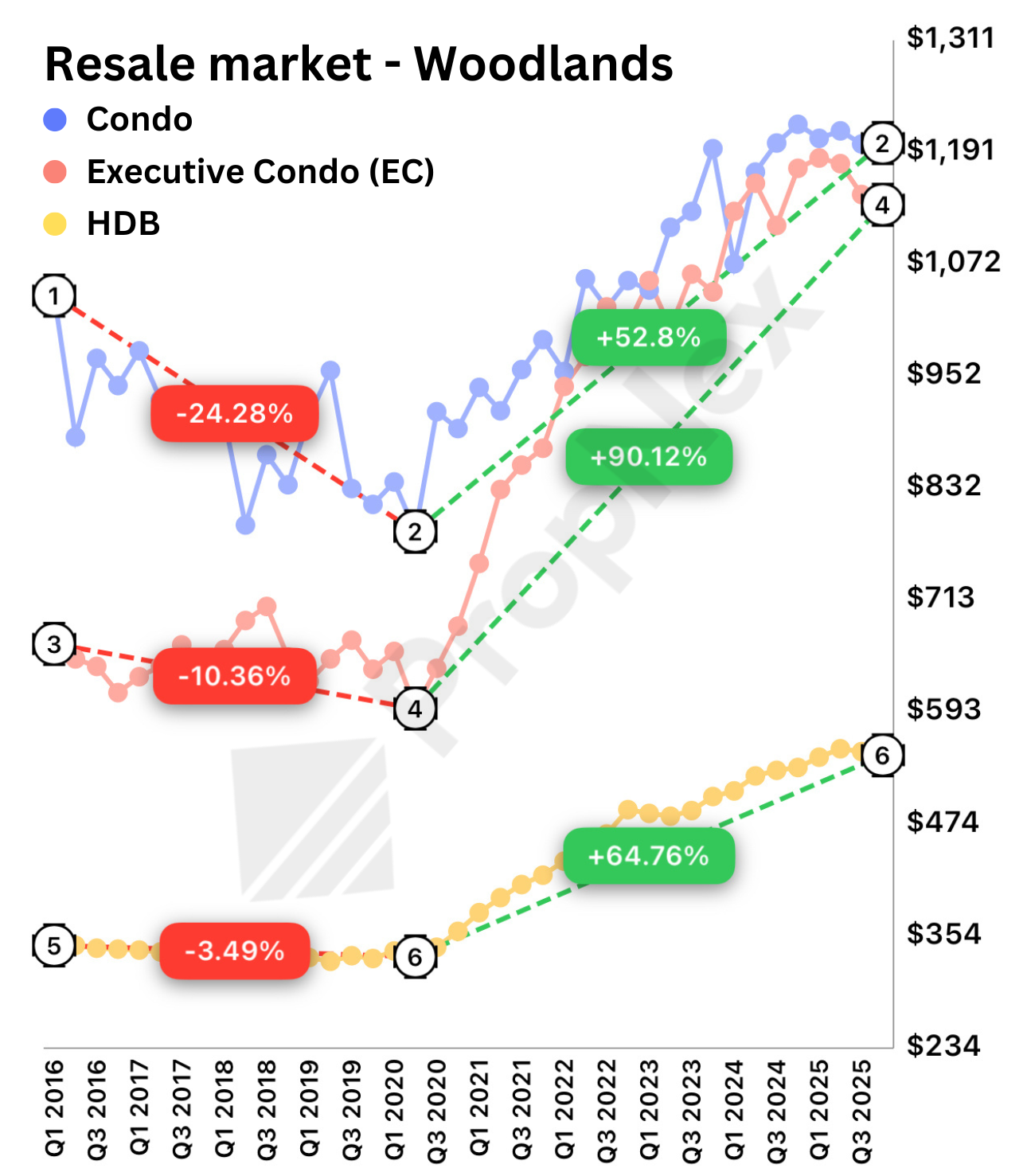

Residential prices in Woodlands are already reflecting this narrative, climbing steeply since 2Q2020. It's especially impressive if we compare it to the negative growth the town was seeing in the previous years leading to the pandemic.

Source: PropNex Investment Suite

Yes, Covid changed buying patterns across the board, with OCR homes benefiting from remote work and lifestyle changes. But in Woodlands' case, the price momentum is also supported by structural factors like employment decentralisation, growing cross-border economic activity, and infrastructure-led demand. We're even seeing million-dollar HDB flats hitting the resale market in recent years.

More importantly, there are already new launches planned for the area such as:

- Woodlands 2 Residences, a mixed-use development with office and retail space, as well as 440 residential units

- Norwood Grand, a condo offering 348 units expected to TOP in 2028

- Woodlands Drive 17, the first EC in Woodlands in almost 10 years, offering an estimated 420 units, and

- North Grove, a standard BTO project with key collection scheduled for 2030

Overall, this indicates that Woodlands will have a healthy supply to prepare for future residents.

If Woodlands is Singapore's northern gateway, then Johor Bahru is the other side of that same door. It's not hard to see why interest in JB properties has been picking up. Regardless, it's still the more affordable option of the two.

The typical transaction range in JB is between RM400,000 - RM800,000, or around S$127,000 - S$254,000. The price disparity is stark, but why?

At the risk of stating the obvious, Malaysia is simply more affordable. From food, transport, childcare, domestic help, to services like renovation and maintenance. So it's not a surprise that housing is also cheaper. And of course, there's the exchange rate. SGD simply stretches much further in Malaysia, which makes the affordability gap stand out even more.

However, JB's affordability comes with extra layers of uncertainty, much like any other overseas property. For one thing, project timelines in Malaysia can be less predictable, and some developments may take longer than expected to complete, which can seem a bit sus.

In the past, parts of the JB market have also struggled with oversupply, which contributed to long periods of price stagnation and, in some cases, price declines. That said, some of this excess supply has been gradually absorbed in recent years, particularly in areas benefiting from improved connectivity and renewed cross-border activity. While this points to a more balanced market than before, future performance will still depend on how demand linked to these broader transformations materialises over time.

Plus, Singapore-based agents are understandably less familiar with Malaysian developers and regulatory frameworks. Unlike the local market, where agents have access to detailed transaction records, development histories, and long-term price trends, information on overseas projects is often less standardised. This means buyers typically need to rely more heavily on independent research when assessing pricing, developer track records, and potential risks.

Of course, none of this makes JB a bad choice. It just means you need more patience and due diligence.

With all the transformations in motion, it's clear that both Woodlands and JB have a positive long-term outlook. As cross-border commuting and business activity increase, housing demand in both locations is likely to be supported.

Buying in Woodlands will cost more, but it's also the more familiar and historically safer bet. Residential property in Singapore tends to hold its value well over longer holding periods, which is why even when a particular unit doesn't end up being the top performer in its area, it's unlikely you'll lose money. So you don't have to worry so much about buying the 'wrong' property.

On the other hand, buying in JB is significantly cheaper, but the risks are also higher. Outcomes are more sensitive to execution, policy direction, and cross-border dynamics. Price performance in JB has historically been more uneven, and Singapore agents have limited access to data that could help you make informed decisions.

So ultimately, this isn't really about which market is "better". It comes down to the kind of risk you're comfortable taking on as well as your purpose for buying the property.

For example, if the home is for your own stay, practicality might matter more than price alone. For those planning to live and work in JB, buying there can make sense, especially given the lower entry cost and day-to-day expenses. But if your life is firmly anchored in Singapore, (you work here, your kids go to school here, your entire family is here, and so on), then living in JB would pose certain challenges. So it's up to you to decide if the lower price entry is worth the hassle of cross-border commuting everyday amongst other constraints.

In the end, you need to have a clear goal in mind to make the right property decision, not just chase cheap properties out of FOMO. Whether you're thinking about buying locally or looking across the border, it helps to understand how each option fits into your longer-term plans, risk tolerance, and lifestyle priorities.

This is the kind of mindset that we encourage in our Property Wealth System (PWS). Not to tell people what to buy, but rather help them evaluate property decisions within the context of their own financial and life plans.

For those interested, we've also included a short clip from a recent Q&A, where our Executive Chairman, Ismail Gafoor, shares his perspective on investing in SEZ-related properties.

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position. No part of this content may be reproduced, distributed, transmitted, displayed, published, or broadcast in any form or by any means without the prior written consent of PropNex.

For permission to use, reproduce, or distribute any content, please contact the Corporate Communications department. PropNex reserves the right to modify or update this disclaimer at any time without prior notice.